SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑þ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

|

| Becton, Dickinson and Company |

| (Name of Registrant as Specified In Its Charter) |

| | | | |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box)all boxes that apply): |

| ☑ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | | | |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | | | |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | | | | |

| | | Becton, Dickinson and Company 1 Becton Drive Franklin Lakes, New Jersey 07417-1880 www.bd.com |

| | | | | |

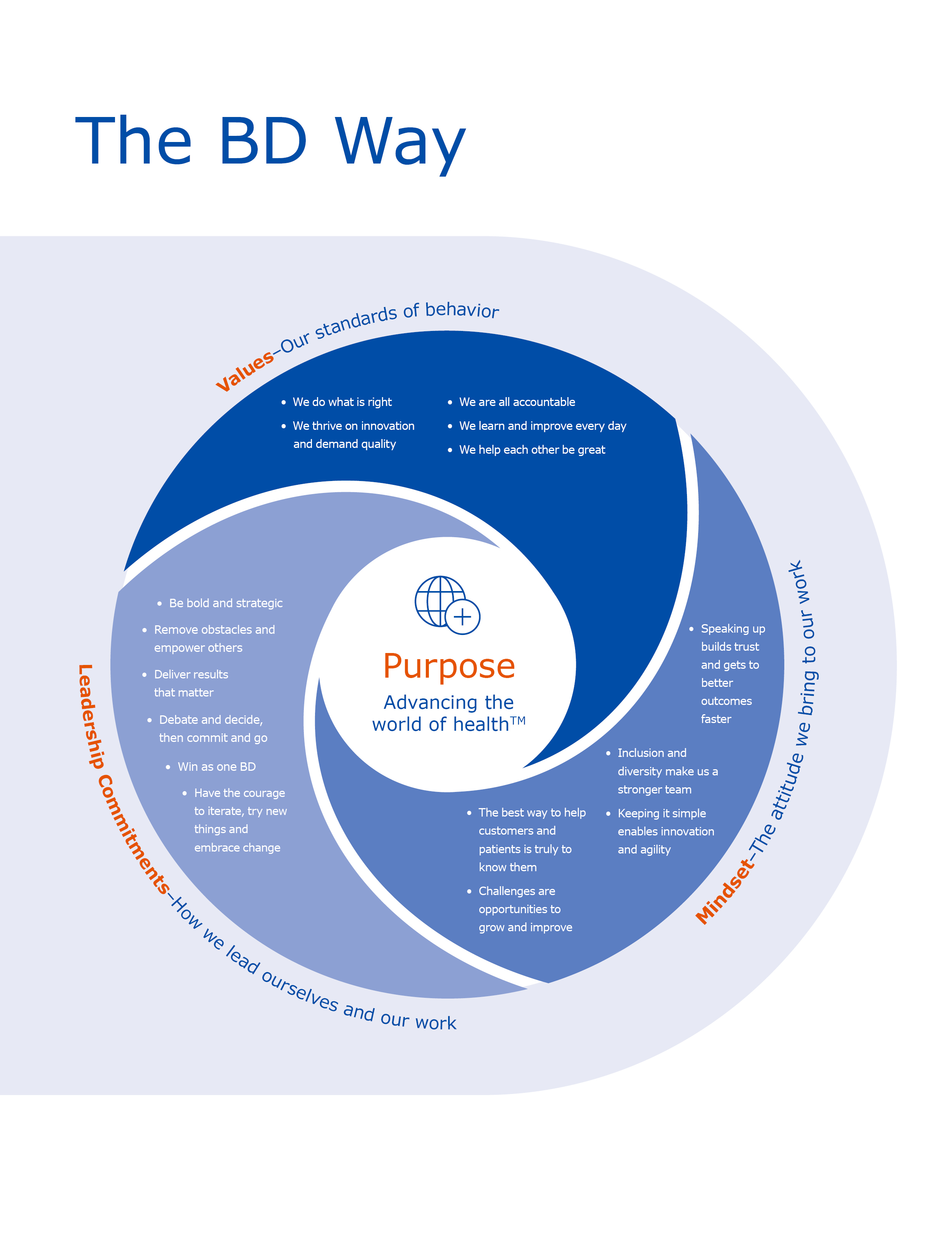

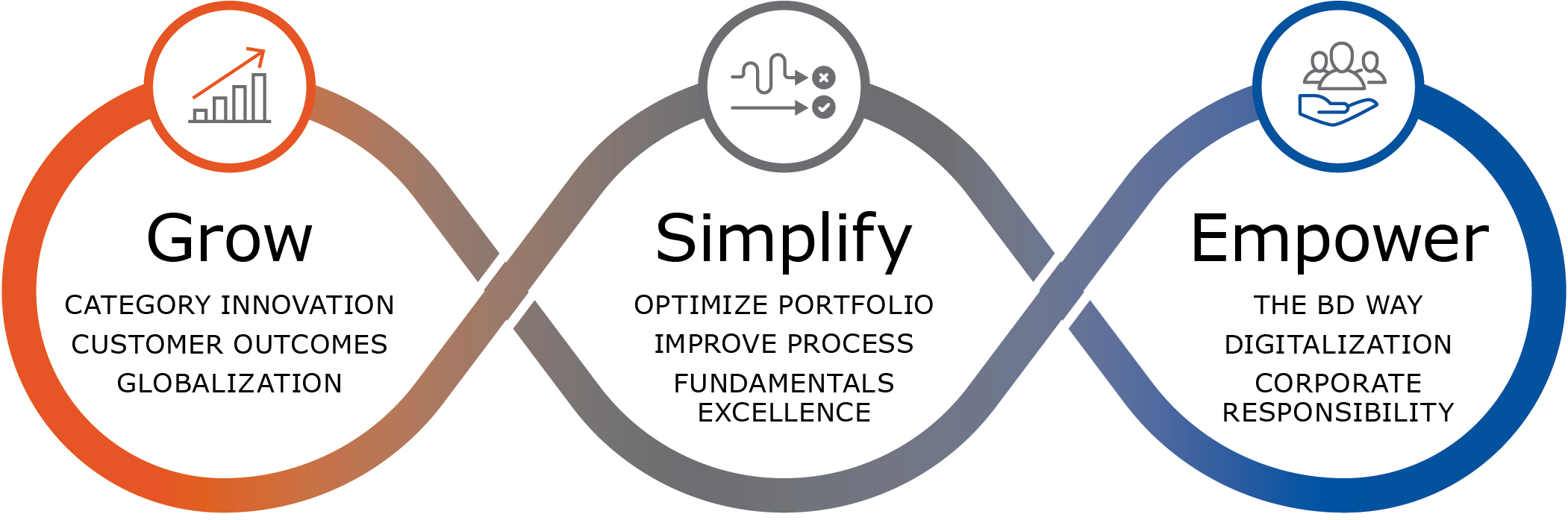

| December 14, 2023 Dear fellow shareholders: As advanced technology and innovation continue to redefine the future of industries, BD is accelerating the integration of robotics, AI, automation and other technologies that have the potential to transform care. Our teams are harnessing this power to deliver innovations that make healthcare simpler, more connected and more accessible. In fiscal year 2023, we delivered another year of consistent performance as a result of continued execution on our BD 2025 strategy to Grow, Simplify and Empower our company. This strategy is fueling our acceleration into a more innovative, agile MedTech leader that is making great contributions to society, delivering great performance and confirming BD is a great place to work. Through our focus on execution, we are repositioning BD into higher-growth markets and achieving consistent, strong financial performance, as we seek to deliver sustained value for all stakeholders through challenging macroenvironments. Our growth strategy has led to new innovations that benefit researchers, providers and patients, and our differentiated medical technologies are improving the efficiency of healthcare and the lives of patients around the world. Notably, we delivered on our top priority as a company – obtaining 510(k) clearance for the updated BD Alaris™ Infusion System – bringing this best-in-class device to our customers and their patients who rely on us. We launched 27 new products this year, completed the integration of Parata Systems – which is now part of our Pharmacy Automation business – and are helping to discover new treatments and insights through technologies like BD FACSDiscoverTM S8 Cell Sorter. We are also empowering the delivery of new biologics, such as the growing drug class of GLP-1s for diabetes and weight loss, delivered through our injection solutions. Integral to our success is our cultural foundation, The BD WAY, and our passion to deliver on our purpose of advancing the world of health™. This year, we made meaningful and measurable progress on our environmental, social and governance (ESG) strategy, Together We Advance, from reducing our environmental footprint and addressing the sustainability needs of our customers, to empowering our diverse and thriving workforce. We continue to address health disparities by advancing health equity in under-resourced areas of the world. We have an opportunity to not just develop meaningful healthcare technologies, but to help make these innovations available to people regardless of geography, demographics or socioeconomic status. Behind these achievements is the dedication of our more than 70,000 global associates whose brilliance, passion and hard work is bringing life-changing products and solutions to patients and providers in every corner of the world, every day. As we look ahead, we will remain disciplined in executing BD 2025, advancing impactful innovation and our shift into higher growth markets, accelerating our cost leadership, and continuing to deliver on quality and service excellence. We will maintain our disciplined and balanced capital deployment framework, which allows us to support investments in growth while returning capital to shareholders, and seek to continue our long-standing recognition as a member of the S&P 500 Dividend Aristocrats Index, having announced our 52nd consecutive year of dividend increases. I’m confident that we’re advancing in the right areas to capitalize on the opportunities ahead, position ourselves well for sustained performance and contribute meaningfully to healthcare globally. Thank you for your continued support of BD. We look forward to your participation in the 2024 Annual Meeting of Shareholders. Sincerely, Tom Polen Chairman, Chief Executive Officer and President |

| | | | | |

| 2024 Notice of Annual Meeting and Proxy Statement | 1 |

Table of contents

| | | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| 2 | |

Notice of annual meeting of shareholders

| | | |

| | | | |

| | |

| Date: | | (5) | | Total fee paid: |

| | | | |

| | | | |

| | |

| | ☐ | | Fee paid previously with preliminary materials.January 23, 2024 |

| |

☐Time: | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.1:00 p.m. Eastern Standard Time |

| | |

| Location: | | (1) | | Amount Previously Paid: |

| | | | |

| | | | The Breakers Palm Beach 1 South County Road Palm Beach, Florida |

| | |

| Record Date: | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | | | |

| | |

| | (3) | | Filing Party: |

| | | | |

| | | | |

| | |

| | (4) | | Date Filed: |

| | | | |

| | | | December 4, 2023 |

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

www.bd.com

December 14, 2017

Dear Fellow Shareholders:

You are cordially invited to attend the 2018The Annual Meeting of Shareholders of Becton, Dickinson and Company, a New Jersey corporation (“BD”) to, will be held on Tuesday, January 23, 2024, at 1:00 p.m. EST on Tuesday, January 23, 2018Eastern Standard Time ("EST"), at The Breakers Palm Beach, 1 South County Road, Palm Beach, Florida (the “2024 Annual Meeting”).

At the

Four Seasons Hotel New York, 57 East 57th Street, New York, New York.The accompanying notice of meeting and proxy statement describe the matters to be acted upon at the meeting. We also will report on matters of interest to BD shareholders.

Your vote is important. Whether or not you plan to attend the2024 Annual Meeting, in person, we encourage you to vote so that your sharesshareholders will be representedconsider and voted atact upon the meeting. You may vote by proxy on the Internet or by telephone, or by completing and mailing the enclosed proxy card in the return envelope provided. You may also vote in person at the Annual Meeting.

Thank you for your continued support of BD.

following proposals: |

Sincerely, |

|

|

Vincent A. Forlenza

|

Chairman and Chief Executive Officer

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Becton, Dickinson and Company

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

December 14, 2017

The 2018 Annual Meeting of Shareholders of Becton, Dickinson and Company (“BD”) will be held as follows:

| | |

DATE: | | Tuesday, January 23, 2018 |

TIME:1. | | 1:00 p.m. EST |

LOCATION: | | Four Seasons Hotel New York

57 East 57th Street

New York, New York

|

PURPOSE: | | To consider and act upon the following proposals: |

| | 1. The election as directors of the thirteeneleven nominees named in the attached proxy statement for aone-year term;

term |

| 2. | | 2. The ratification of the selection of the independent registered public accounting firm;

firm |

| 3. | | 3. An advisory vote to approve named executive officer compensation;

compensation |

| | 4. A shareholder proposal to amend BD’s proxy accessby-law, if properly presented at the meeting; and

|

| | 5. Such other business as may properly come before the meeting or any adjournment or postponement thereof.

|

Shares represented by

We will also transact such other business as may properly

executed proxies will be voted in accordance withcome before the

instructions specified therein. Shares represented by properly executed proxies that do not provide specific voting instructions will be voted in accordance with the recommendations of BD’s Board of Directors set forth in the accompanying proxy statement.Important Notice Regarding the Availability of Proxy Materials for the 2018 Annual Meeting of Shareholders to be held on January 23, 2018. BD’s proxy statement and 2017 Annual Report, which includes BD’s consolidated financial statements, are available atwww.edocumentview.com/BDX.

meeting, or any adjournment or postponement thereof.

Shareholders of record

atas of the close of business on December

8, 2017 will be4, 2023 are entitled to

attendnotice of and

to vote at the

meeting. |

By order of the Board of Directors, |

|

|

Gary DeFazio |

Senior Vice President and Corporate Secretary |

YOU CAN VOTE BY PROXY OR SUBMIT VOTING INSTRUCTIONS IN

ONE OF THREE WAYS:

Visit the website noted on your proxy/voting instruction card.

Use the telephone number noted on your proxy/voting instruction card.

Promptly return your signed and dated proxy/voting instruction card in the envelope provided.

PROXY STATEMENT

2018 ANNUAL MEETING OF SHAREHOLDERS

Tuesday, January 23, 2018

BECTON, DICKINSON AND COMPANY

1 Becton Drive

Franklin Lakes, New Jersey 07417-1880

GENERAL INFORMATION

Proxy solicitation

2024 Annual Meeting (or any adjournment or postponement thereof). These proxy materials are being mailed or otherwise sent to shareholders of Becton, Dickinson and Company (“BD”)BD on or about December 14, 20172023.

By order of the Board of Directors,

Gary DeFazio

Senior Vice President and Corporate Secretary

| | | | | | | | |

| How To Vote |

| | |

| By Mail | By Telephone | Online |

Sign, complete and return the

proxy card in the postage-paid

envelope provided | 1-800-652-8683 | www.envisionreports.com/BDX |

| | |

|

| Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Shareholders to be held on January 23, 2024: BD’s proxy statement and 2023 Annual Report to Shareholders, which includes BD’s consolidated financial statements, are available at www.edocumentview.com/BDX. |

|

| | | | | |

| 2024 Notice of Annual Meeting and Proxy Statement | 3 |

Proxy statement overview

This summary highlights information contained elsewhere in connectionthis proxy statement and does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting.

Proposals to be considered at the 2024 annual meeting

| | | | | | | | | | | |

| Proposal | Board Recommendation |

| | | |

| 1. | The election as directors of the eleven nominees named in the attached proxy statement for a one-year term | | FOR each of the nominees fordirector |

| 2. | The ratification of the selection of the independent registered public accounting firm | | FOR |

| 3. | An advisory vote to approve named executive officer compensation | | FOR |

| | | |

BD is an innovative medtech leader with global reach and scale addressing healthcare’s most pressing challenges

| | | | | | | | | | | | | | | | | | | | | | | |

| 190+ countries served | | | 34B+ devices made annually |

| | | | | | | |

| | | |

| ~6% of sales annual R&D investment | | 33,000+ active patents |

| | | | | |

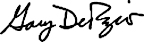

| FY23 Revenues by Segment | FY23 Revenues by Region |

| |

|

Note: Percentages in above tables are rounded.

The BD 2025 strategy positions us to drive future value creation.

2023 financial performance*

| | | | | | | | |

$19.4B Total Revenues | $5.10 Reported EPS $12.21 Adjusted EPS | ~$3.0B Operating Cash Flow |

| | | | | |

| Multi-year execution of BD 2025 strategy yields consistent growth and margin improvement | Through our team’s focused execution, we drove significant margin expansion and delivered strong double-digit, currency-neutral, EPS growth, despite a challenging macroeconomic environment. •Delivered on our number one priority – obtaining FDA clearance for the updated BD Alaris™ Infusion System. •Significantly advanced our innovation pipeline, launching 27 key new products that benefit researchers, providers, and patients – integrating AI, robotics, and other advanced technologies. •Reported FY23 revenues increased 2.7%, while base business revenues (which excludes COVID-19 only diagnostic testing)* increased 5.1% reported, and increased 7.0% currency-neutral*. •Reported FY23 earnings per share ("EPS") from continuing operations was $5.10, and adjusted EPS from continuing operations* was $12.21. |

| Our disciplined and strategic capital allocation plan continues to provide value creation opportunities | Purposeful and balanced investments help fuel growth, maintain financial flexibility and return capital to shareholders. •R&D spending of $1.2 billion, to advance our pipeline of innovative programs that will support our strong growth profile in 2024 and beyond. •Paid down approximately $700 million of long-term debt, pursuant to our balanced capital allocation framework and our commitment to reduce outstanding long-term debt. •Ended year with a net leverage* ratio of 2.6 times - our strongest since 2021, which positions us well to capitalize on opportunities to accelerate our investment in higher-growth categories through our tuck-in M&A strategy. •Returned approximately $1.1 billion to shareholders during the year through dividends, continuing our long-standing recognition as a member of the S&P 500 Dividend Aristocrats index. |

| Simplification of portfolio driving operational excellence and creating shareholder value | •Successfully completed the divestiture of our former Surgical Instrumentation Platform, allowing for reallocation of resources towards more strategic, higher-growth areas. •Progressed Project RECODE network and portfolio rationalization programs, having now streamlined our portfolio by 20% compared to 2019, achieving our goal laid out at our 2021 Investor Day two years early. |

* We refer above to certain financial measures that do not conform to generally accepted accounting principles ("GAAP"). Appendix A to this proxy statement contains reconciliations of these non-GAAP measures to the solicitationcomparable GAAP financial measures. Financial information presented in the tables reflect BD’s results on a continuing operations basis.

| | | | | |

| 2024 Notice of Annual Meeting and Proxy Statement | 5 |

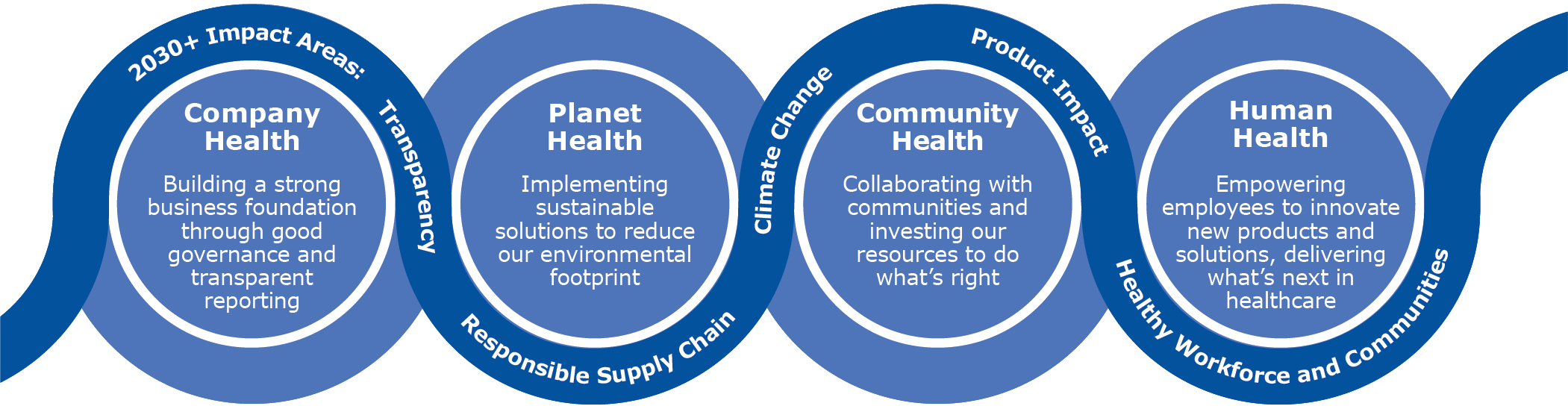

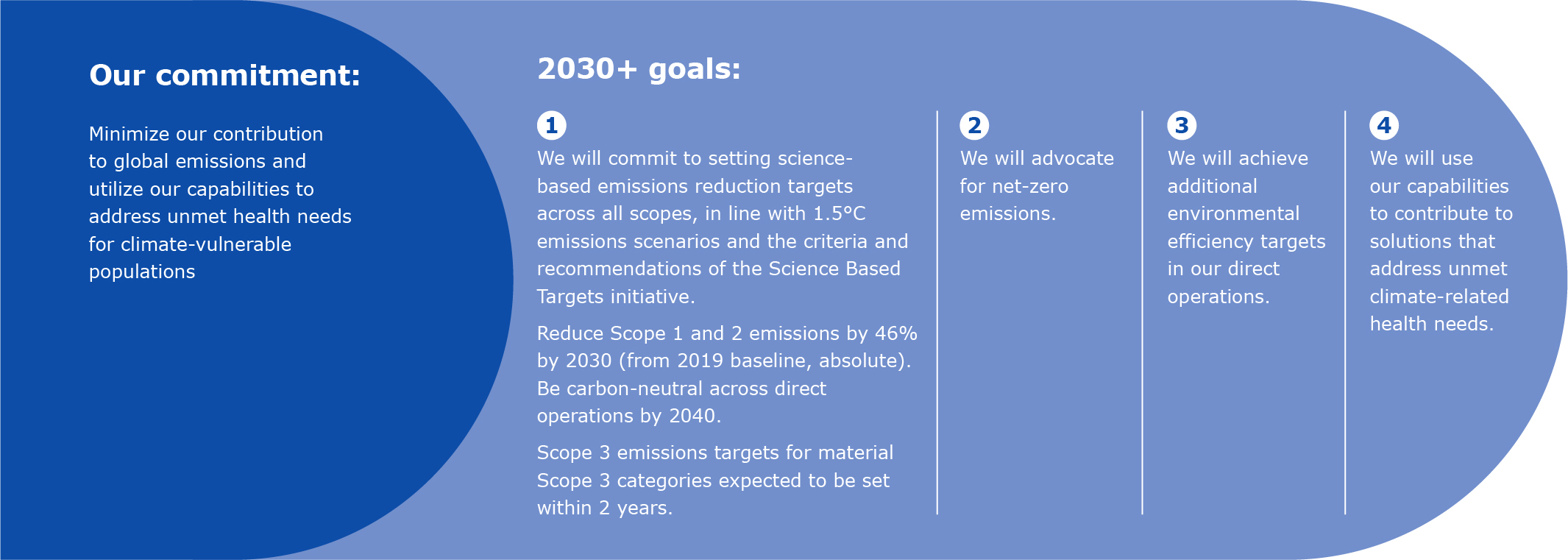

ESG — Together We Advance

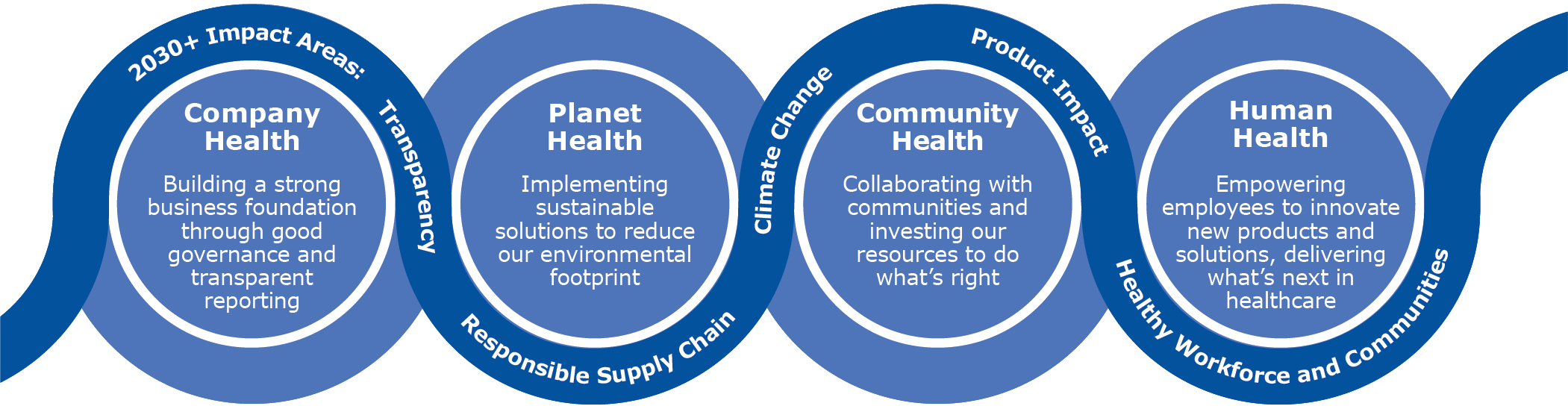

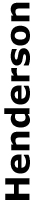

BD’s strategic initiative to advance environmental, social and governance (“ESG”) matters – Together We Advance – was launched in early fiscal year 2022. The Together We Advance initiative focuses on enhancing stewardship of proxiesthe company, the planet, communities and human health, which serves as a framework through which BD addresses the most relevant ESG issues for BD and its stakeholders. BD has made commitments in five areas where we see the most opportunity to create meaningful change over the next decade: climate change, product impact, a responsible supply chain, a healthy workforce and community, and transparency. For more information regarding BD's ESG strategy and 2030+ ESG goals, see page 31 and our 2022 ESG Report, which is available at www.bd.com/en-us/about-bd/esg#sustainabiity. Our 2022 ESG Report is not part of, or incorporated by reference into, this proxy statement.

As part of our continued commitment to transparency and progress on driving inclusion and equity throughout the company, we publish our Global Inclusion, Diversity and Equity Report, which summarizes BD's inclusion, diversity and equity ("ID&E") accomplishments and highlights the ways that inclusion is central to our culture. Our most recently filed U.S. Federal Employment Information Report (EEO-1) and our latest Global Inclusion, Diversity and Equity Report are each available at www.bd.com/en-us/about-bd/esg#inclusiondiversityequity, which are not part of, or incorporated by reference into, this proxy statement. For additional information regarding our ID&E efforts, including pay equity, see page 34.

For additional information regarding our ESG Reports, see “Note About Website and ESG Reports,” on page 35.

Proposals to be considered at the 2024 annual meeting

| | | | | | | | |

| |

Proposal 1 | Election of directors |

| |

| |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR. |

| |

A more detailed discussion of this proposal and related disclosures can be found beginning on page 12.

| | | | | | | | | | | | | | | | | | | | |

| Director Nominee Name | Age | Director

Since | Committee Membership |

| AC | CHCC | QRC | CGNC |

William M. Brown  Former Chairman and Chief Executive Officer, L3Harris Technologies | 61 | 2022 | | | | |

Catherine M. Burzik  Former President and Chief Executive Officer, Kinetic Concepts, Inc. | 73 | 2013 | | | | |

Carrie L. Byington, M.D.  Special Adviser to the President, University of California Health | 60 | 2021 | | | | |

R. Andrew Eckert  Former Chief Executive Officer, Zelis Inc. | 62 | 2016 | | | | |

Claire M. Fraser, Ph.D.  Founding Director, Institute for Genome Sciences | 68 | 2006 | | | | |

Jeffrey W. Henderson  Former Chief Financial Officer, Cardinal Health Inc. | 59 | 2018 | | | | |

Christopher Jones  Former Chief Executive Officer, JWT Worldwide | 68 | 2010 | | | | |

Thomas E. Polen Chairman, Chief Executive Officer and President, BD | 50 | 2020 | | | | |

Timothy M. Ring  Former Chairman and Chief Executive Officer, C. R. Bard, Inc. | 66 | 2017 | | | | |

Bertram L. Scott   Former Chief Executive Officer, Affinity Health Plan | 72 | 2002 | | | | |

Joanne Waldstreicher, M.D.  Former Chief Medical Officer, Johnson & Johnson | 63 | 2023 | | | | |

| | | | | | | | | | | |

AC – Audit Committee CHCC – Compensation and Human Capital Committee QRC – Quality and Regulatory Committee CGNC – Corporate Governance and Nominating Committee | | | Chair |

| | Member |

| | Independent |

| | Lead Director |

| | | | | |

| 2024 Notice of Annual Meeting and Proxy Statement | 7 |

Nominee snapshot

| | | | | | | | | | | |

| Tenure | Age |

| > 10 years | | ≥ 70 years | |

| 5-10 years | | 61-69 years | |

| < 5 years | | ≤ 60 years | |

7.9years (average director tenure) | 63.8 years old (average director age) |

Nominee representation

Total Number of Nominees: 11

| | | | | | | | |

| Female | Male |

| Director Nominees | 4 | 7 |

| | |

| Number of Director Nominees who identify in Any of the Categories |

| African American or Black | — | 1 |

| Alaska Native or Native American | — | — |

| Asian | — | — |

| Hispanic, Latino or Spanish Origin | 1 | — |

| Native Hawaiian or Other Pacific Islander | — | — |

| White | 3 | 6 |

| Other | — | — |

| Two or More Races or Ethnicities | — | — |

| Did not Disclose Demographic Background | — | — |

Governance best practices

BD’s commitment to good corporate governance is embodied in our Statement of Corporate Governance Principles ("Governance Principles"). The Governance Principles set forth the BD Board of

Directors (the “Board”) for BD’s 2018 Annual Meeting of Shareholders (the “2018 Annual Meeting”) to be held at 1:00 p.m. EST on Tuesday, January 23, 2018 at the Four Seasons Hotel New York, 57 East 57th Street, New York, New York.BD’s directorsDirector’s views and its officers and other BD associates also may solicit proxies by telephone or otherwise. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses. BD has retained MacKenzie Partners, Inc. to assist in soliciting proxies forpractices regarding a fee not to exceed $25,500 plus expenses. The cost of soliciting proxies will be borne by BD.

Important Notice Regarding the Availability of Proxy Materials for the 2018 Annual Meeting of Shareholders to be held on January 23, 2018. This proxy statement and BD’s 2017 Annual Report to Shareholders are also available atwww.edocumentview.com/BDX.

Shareholders entitled to vote; Attendance at the 2018 Annual Meeting

Shareholders of record at the close of business on December 8, 2017 are entitled to notice of, and to vote at, the meeting. As of such date, there were 229,407,806 shares of BD common stock outstanding, each entitled to one vote.

If your shares are held in the name of a bank, broker or other nominee (also known as shares held in “street name”) and you wish to attend the meeting, you must present proof of ownership as of the record date, such as a bank or brokerage account statement, to be admitted. BD may request appropriate identification for any person seeking to attend the meeting as a condition of admission.

Quorum; Required vote

The holders of a majority of the shares entitled to vote at the meeting must be present in person or represented by proxy to constitute a quorum. Directors are elected by a majority of the votes cast at the meeting (Proposal 1). If an incumbent director receives a greater number of votes “against” the director’s election than votes “for” such election, the director must offer to submit his or her resignation,governance topics, and the Board will decide whether to acceptCorporate Governance and Nominating Committee (the "Governance Committee") assesses the offer to resignGovernance Principles on an ongoing basis in accordance with the process describedlight of current best practices.

The following is a summary of our significant corporate governance practices. A further discussion of our governance practices can be found beginning on page 21 of this proxy statement. Approval of each of Proposal 2 (ratification36.

| | |

| Corporate Governance Practices |

|

•Annual election of directors •Majority voting standard for election of directors •10 out of 11 director nominees are independent •Robust lead director structure •Rigorous annual board self-evaluation and director renomination process •Shareholder right to call special meetings •Proxy access bylaw •Shareholder right to act by written consent •Restrictions on corporate political contributions •Annual report of charitable contributions •Director and executive officer share ownership requirements •Overboarding policy •No poison pill •Active shareholder engagement process •Mandatory director retirement policy •Robust director orientation and education process |

|

| | | | | | | | |

| |

Proposal 2 | Ratification of selection of independent registered public accounting firm |

| |

| |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 2. |

| |

Ernst & Young LLP (“E&Y”) has been selected by the Audit Committee as the Company’s independent registered public accounting firm), Proposal 3 (advisory votefirm (referred to approve named executive compensation),herein as the “independent auditors”) for fiscal year 2024. The Audit Committee is solely responsible for the appointment, compensation, retention and Proposal 4 (shareholder proposal) requiresoversight of BD’s independent auditors. Shareholders are being asked to ratify the affirmative voteAudit Committee’s selection of E&Y. If ratification is withheld, the Audit Committee will reconsider its selection.

A representative of E&Y is expected to attend the 2024 Annual Meeting to respond to appropriate questions and will have the opportunity to make a majoritystatement.

| | | | | |

| 2024 Notice of Annual Meeting and Proxy Statement | 9 |

| | | | | | | | |

| |

Proposal 3 | Advisory vote to approve named executive officer compensation |

| |

| |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 3. |

| |

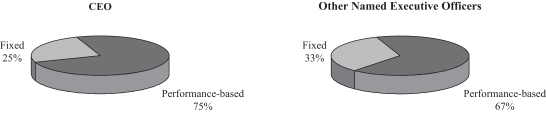

The Compensation and Human Capital Committee (the "Compensation Committee") believes the primary objective of the

votes cast atBD compensation program is to fully support the

meeting.Under New Jersey law, abstentionsstrategic business goal of delivering superior long-term shareholder returns through sustained profitable revenue growth, EPS growth, and shares that brokers do not havereturn on capital. As such, the authorityprogram is intended to vote in the absenceensure a high degree of timely instructions from the beneficial owners will not be counted as votes cast, and, accordingly, will have no effect on the outcome of the vote for any of the proposals.

How to vote

Shareholders of record may cast their votes at the meeting. In addition, shareholders of record may cast their votes by proxy, and participants in the BD plans described below may submit their voting instructions, by:

using the Internet and voting at the website listed on the enclosed proxy/voting instruction card (the “proxy card”);

using the telephone number listed on the proxy card; or

signing, completing and returning the proxy card in the postage-paid envelope provided.

Votes and voting instructions provided through the Internet and by telephone are authenticated by use of a personal identification number. This procedure allows shareholders to appoint a proxy,alignment between pay and the various plan participants to provide voting instructions,long-term value and to confirm that their actions have been properly recorded. Specific instructions to be followed are set forthfinancial soundness of BD.

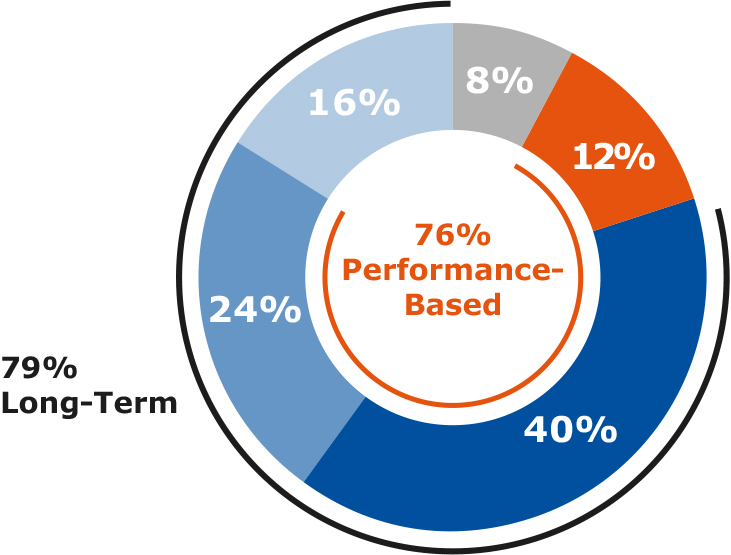

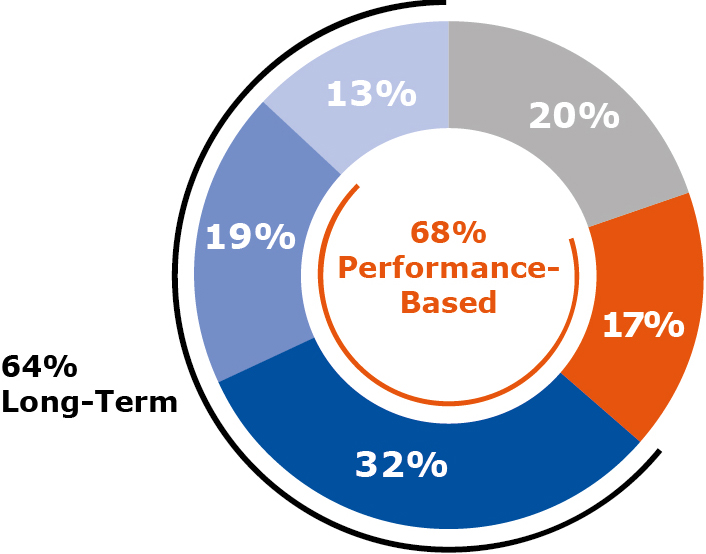

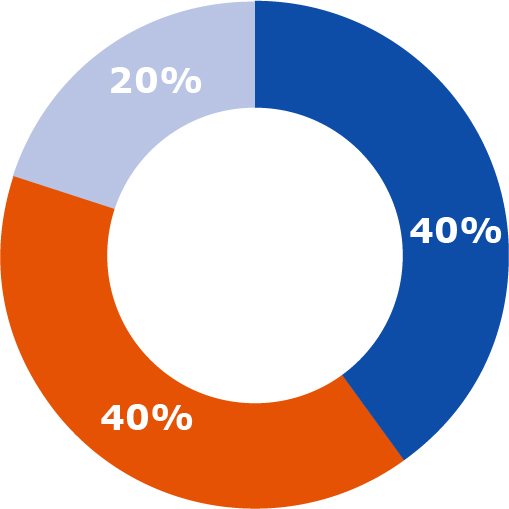

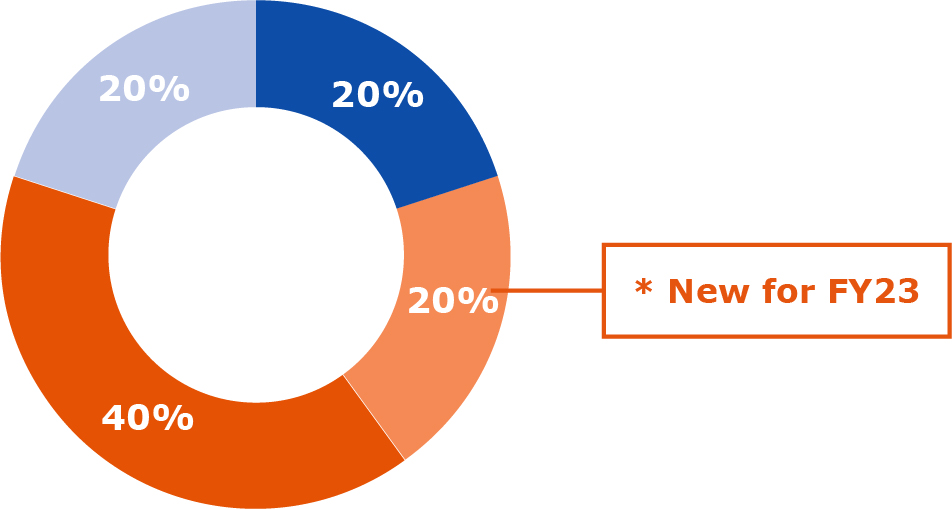

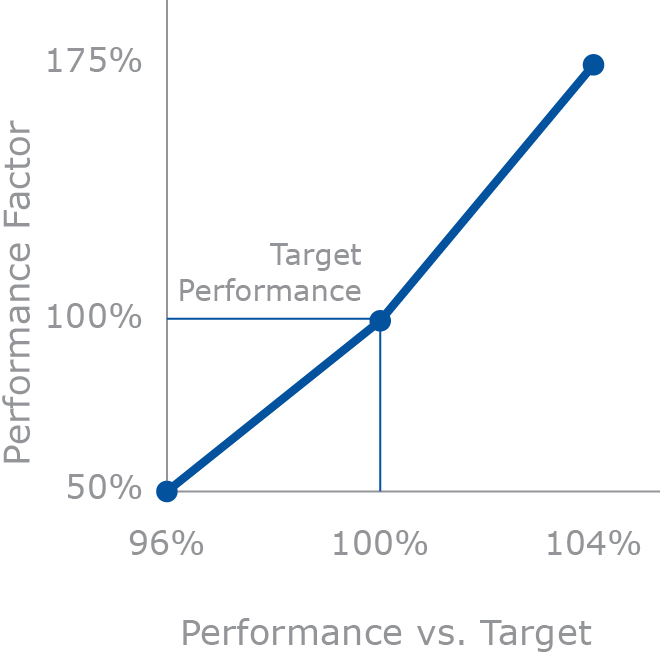

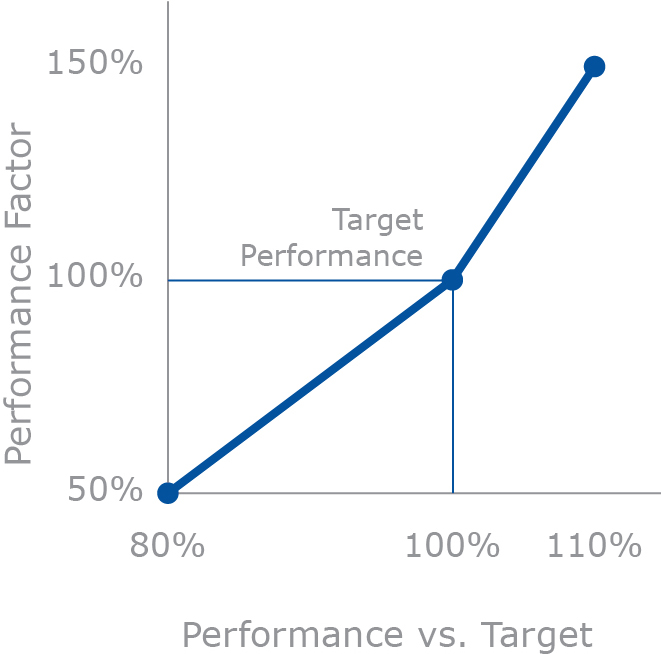

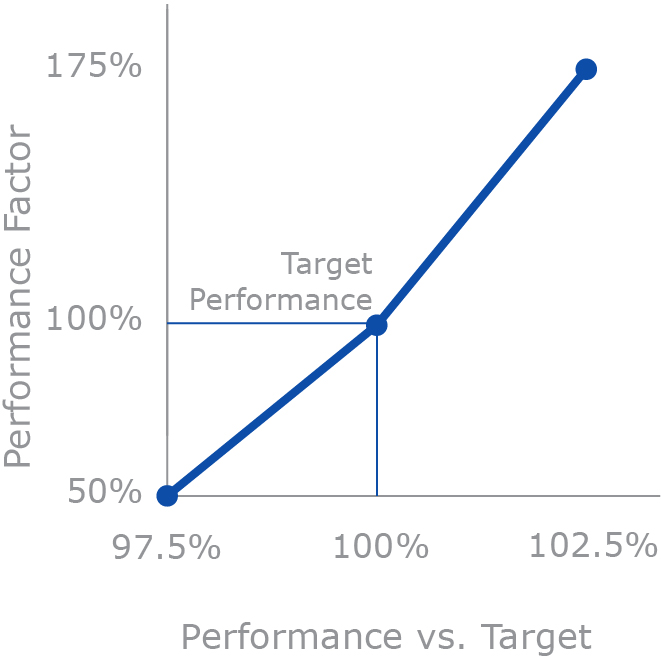

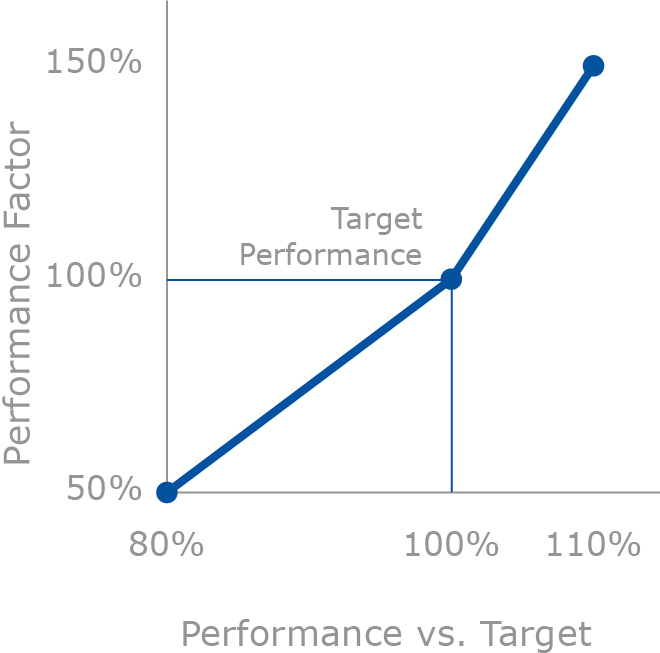

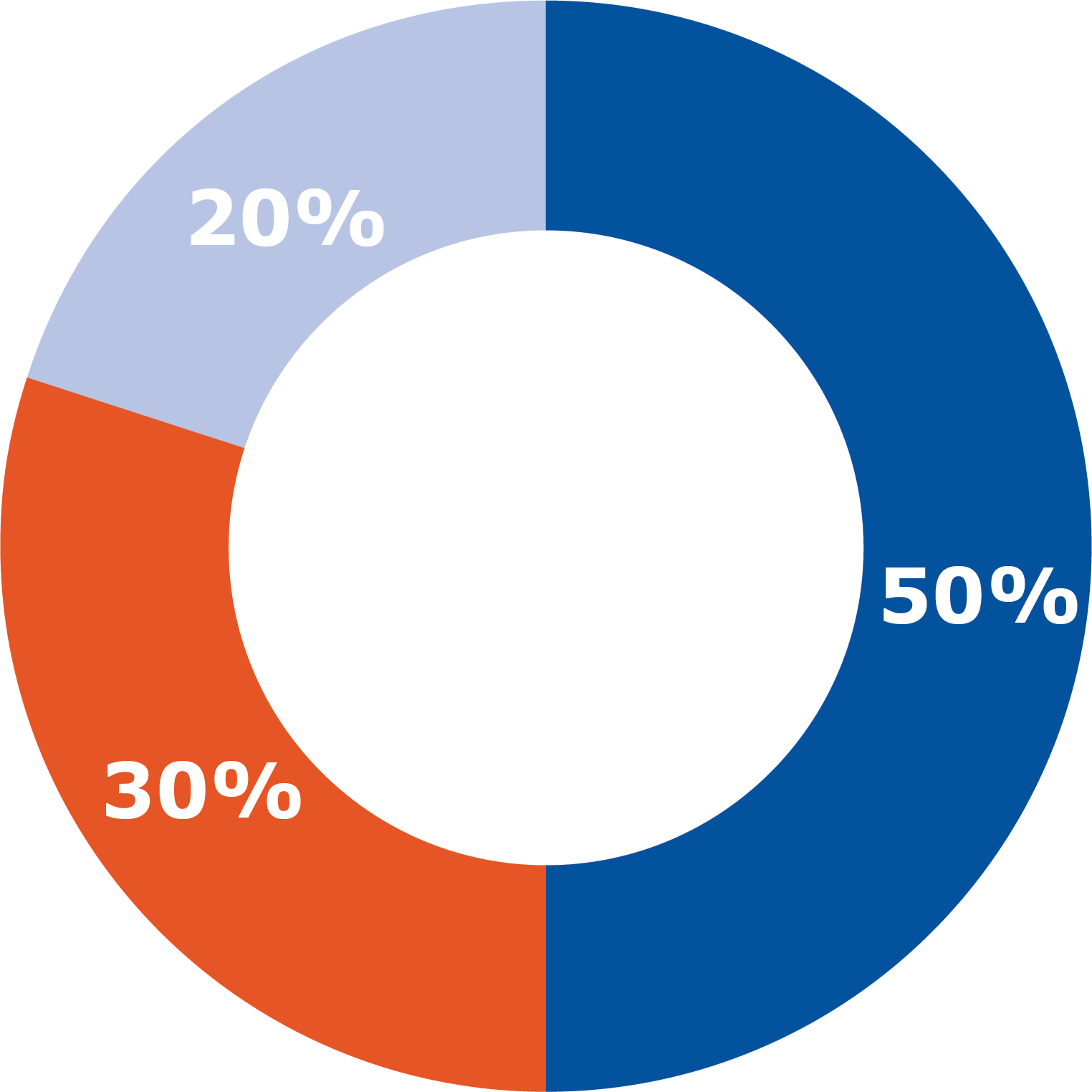

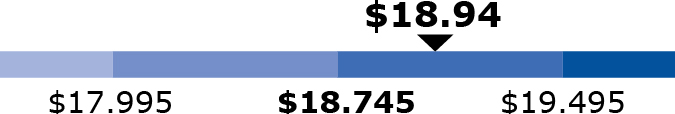

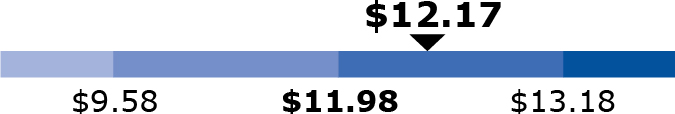

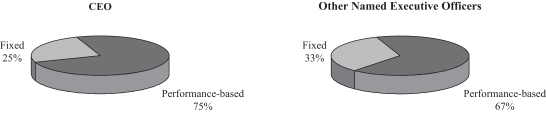

CEO target direct compensation mix

Our compensation objectives and practices

| | | | | | | | | | | |

| | What We Do | What We Don’t Do |

| Competitive Compensation Program | |  Use balanced mix of cash and equity compensation and annual and long-term incentives. Use balanced mix of cash and equity compensation and annual and long-term incentives. Have an independent advisor engaged by our Compensation Committee to assist in designing our compensation program and making compensation decisions. Have an independent advisor engaged by our Compensation Committee to assist in designing our compensation program and making compensation decisions. |  No employment agreements with our executive officers. No employment agreements with our executive officers. |

| | | |

| | | |

| Pay for Performance | |  Align executive compensation with the execution of our business strategy by using performance metrics that reward behaviors that support our business objectives and long-term shareholder value. Align executive compensation with the execution of our business strategy by using performance metrics that reward behaviors that support our business objectives and long-term shareholder value. Balance performance metrics in our incentive plans so that undue weight is not given to any one metric, and measure performance over annual and multi-year performance periods. Balance performance metrics in our incentive plans so that undue weight is not given to any one metric, and measure performance over annual and multi-year performance periods. IncorporateESG metrics relating to product quality and efforts to advance inclusion and diversity as a modifier of our annual incentive plan performance factor. IncorporateESG metrics relating to product quality and efforts to advance inclusion and diversity as a modifier of our annual incentive plan performance factor. |  While we emphasize “at risk” pay tied to performance, our program does not encourage excessive risk-taking by management. While we emphasize “at risk” pay tied to performance, our program does not encourage excessive risk-taking by management. No guaranteed incentive awards for executive officers. No guaranteed incentive awards for executive officers. |

| | | |

| | | |

| Strong Compensation Policies | |  Robust share retention and ownership guidelines. Robust share retention and ownership guidelines. Adopted Executive Officer Cash Severance Policy capping cash payments to executives upon termination under new arrangements to 2.99x salary plus bonus. Adopted Executive Officer Cash Severance Policy capping cash payments to executives upon termination under new arrangements to 2.99x salary plus bonus. “Double-trigger” change in control agreements with our executive officers, and double-trigger vesting provisions for equity compensation awards. “Double-trigger” change in control agreements with our executive officers, and double-trigger vesting provisions for equity compensation awards. Clawback policies tied to financial restatements or breaches of restrictive covenants. Clawback policies tied to financial restatements or breaches of restrictive covenants. Pre-established timing for annual equity awards. Pre-established timing for annual equity awards. |  No below market exercise prices or reload provisions for equity awards, and no repricing of equity awards without shareholder approval. No below market exercise prices or reload provisions for equity awards, and no repricing of equity awards without shareholder approval. Prohibition on pledging BD shares or hedging against the economic risk of ownership. Prohibition on pledging BD shares or hedging against the economic risk of ownership. No excise tax "gross-ups" in our change in control agreements. No excise tax "gross-ups" in our change in control agreements. |

| | | |

The Compensation Discussion and Analysis beginning on the proxy card. If you vote through the Internet or by telephone, you do not need to return your proxy card.In order to be timely processed, voting instructions submitted by participants in BD’s Global Share Investment Program (the “GSIP”) must be received by 12:00 p.m. EST on January 17, 2018, and voting instructions submitted by participants in all other BD plans must be received by 12:00 p.m. EST on January 19, 2018. All proxies submitted by record holders through the Internet or by telephone must be received by 11:00 a.m. EST on January 23, 2018.If you are the beneficial ownerpage 47 of shares held in street name, you have the right to direct your bank, broker or other nominee on how to vote your shares by using the voting instruction form provided to you by your nominee, or by following their instructions for voting through the Internet or by telephone. In the alternative, you may vote in person at the meeting if you obtain a valid proxy from your bank, broker or other nominee and present it at the meeting.

Shares represented by properly executed proxies will be voted in accordance with the instructions specified therein. Shares represented by properly executed proxies that do not specify voting instructions will be voted in accordance with the recommendations of the Board set forth in this proxy statement. If you hold your shares in street name, statement describes BD’s executive compensation program

and you do not provide voting instructions the compensation decisions made with respect to your bank, broker or other nominee, your nominee will not be permitted to vote your shares in its discretion on Proposals 1, 3, or 4, but may still be permitted to vote your shares in its discretion on Proposal 2.Participants in BD plans

Participants in the BD 401(k) Plan may instruct the 401(k) Plan trustee how to vote the shares of BD common stock allocated to their 401(k) accounts. Shares for which no voting instructions have been received by the 401(k) Plan trustee will be voted in the same proportion as those shares for which timely instructions are received.

Participants in BD’s Deferred Compensation and Retirement Benefit Restoration Plan (the “Restoration Plan”our Chief Executive Officer ("CEO"), the 1996 Directors’ Deferral Plan (the “Directors’ Deferral Plan”), and the GSIP (if so provided under the terms of the local country GSIP plan) may provide voting instructions for all shares of BD common stock allocated to their plan accounts. The trustees of these plans will vote the plan shares for which they do not receive instructions from participants in the same proportion as the plan shares for which they do receive instructions.

Proxies representing shares of BD common stock held of record also will serve as proxies for shares held under the Direct Stock Purchase Plan sponsored and administered by Computershare Trust Company, N.A. and any shares of BD common stock allocated to participants’ accounts under the plans mentioned above, if the registrations are the same. Separate mailings will be made for shares not held under the same registrations.

Revocation of proxies or change of instructions

A proxy given by a shareholder of record may be revoked or changed at any time before it is voted by:

sending written notice of revocation to the Corporate Secretary of BD at the address set forth above or delivering such notice at the meeting prior to the voting of the proxy,

delivering a proxy (by one of the methods described above under the heading “How to vote”) bearing a later date, or

voting in person by written ballot at the meeting.

Participants in the plans described above may change their voting instructions by delivering new voting instructions by one of the methods described above under the heading “How to vote.”

If you are the beneficial owner of shares held in street name, you may revoke or change your voting instructions in the manner provided by your bank, broker or other nominee, or you may vote in person at the meeting in the manner described above under the heading “How to vote.”

Other matters

The Board is not aware of any matters to be presented at the 2018 Annual Meeting other than those set forth in the accompanying notice. If any other matters properly come before the meeting, the persons named in the proxy card will vote on such matters in accordance with their best judgment.

OWNERSHIP OF BD COMMON STOCK

Securities owned by certain beneficial owners

The following table sets forth as of September 30, 2017, information concerning those persons known to BD to be the beneficial owner of more than 5% of BD’s outstanding capital stock. This information is based on filings made by such persons with the Securities and Exchange Commission (“SEC”).

| | | | | | | | | | | | | | |

Name and address of beneficial owner | | | | Title of Security | | | Amount and

nature of

beneficial ownership | | | Percent of class | |

T. Rowe Price Associates, Inc.

100 E. Pratt Street

Baltimore, MD 21202 | | | | | Common Stock | | | | 30,142,561 | (1) | | | 13.1 | % |

| | | | | Depositary Shares | | | | 15,539,594 | (2) | | | 31.1 | % |

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022 | | | | | Common Stock | | | | 17,740,001 | (3) | | | 7.8 | % |

| | | | | Depositary Shares | | | | 4,809,557 | (4) | | | 9.7 | % |

The Vanguard Group, Inc.

100 Vanguard Boulevard

Malvern, PA 19355 | | | | | Common Stock | | | | 17,587,014 | (5) | | | 7.7 | % |

(1) | The beneficial owner has sole dispositive power with respect to these shares and sole voting power with respect to 9,621,581 shares. |

(2) | The beneficial owner has sole dispositive power with respect to these shares, and sole voting power with respect to 4,137,990 shares. |

(3) | The beneficial owner has sole dispositive power with respect to these shares, and sole voting power with respect to 15,498,075 shares. |

(4) | The beneficial owner has sole dispositive power and voting power with respect to these shares. |

(5) | The beneficial owner has sole dispositive power with respect to 17,187,091 shares and shared dispositive power with respect to 399,923 shares, and sole voting power with respect to 345,159 shares and shared voting power with respect to 62,304 shares. |

Securities owned by directors, nominees and management

The following table sets forth as of December 1, 2017 information concerning the beneficial ownership of BD common stock by (i) each director and nominee, (ii) the executive officers named in the Summary Compensation Table on page 42, and (iii) all68.

| | | | | |

| 2024 Notice of Annual Meeting and Proxy Statement | 11 |

Proposal 1: Election of directors and executive officers as a group. In general, “beneficial ownership” includes those shares that an individual has the sole or shared power to vote or dispose of, including shares that may be acquired under outstanding equity compensation awards or otherwise within 60 days. Except as indicated in the footnotes to the table, each person has the sole power to vote and dispose

Members of the

shares he or she beneficially owns.BD has a policy that prohibits directors, officers and employees from pledging BD shares or engaging in transactions that are intended to hedge against the economic riskBoard of owning BD shares. None of BD’s directors or executive officers has pledged or hedged against any of the shares listed.

BD COMMON STOCK

| | | | | | | | |

Name | | Amount and nature of

beneficial ownership(1) | | | Percentage

of class | |

Basil L. Anderson | | | 31,056 | | | | * | |

Catherine M. Burzik | | | 6,318 | | | | * | |

Alexandre Conroy | | | 135,671 | | | | * | |

R. Andrew Eckert | | | 1,564 | | | | * | |

Vincent A. Forlenza | | | 1,401,461 | | | | * | |

Claire M. Fraser | | | 20,498 | | | | * | |

Christopher Jones | | | 19,287 | | | | * | |

Marshall O. Larsen | | | 22,320 | | | | * | |

Gary A. Mecklenburg | | | 30,870 | | | | * | |

David F. Melcher(2) | | | 0 | | | | * | |

James F. Orr | | | 36,398 | | | | * | |

Willard J. Overlock, Jr. | | | 59,943 | | | | * | |

Thomas Polen | | | 42,222 | | | | * | |

Claire Pomeroy | | | 5,221 | | | | * | |

Christopher R. Reidy | | | 114,857 | | | | * | |

Rebecca W. Rimel | | | 8,900 | | | | * | |

Timothy M. Ring(2) | | | 0 | | | | * | |

Bertram L. Scott | | | 39,613 | | | | * | |

Ellen R. Strahlman | | | 54,945 | | | | * | |

Directors and executive officers as a group (23 persons) | | | 2,349,359 | | | | 1.0 | % |

* | Represents less than 1% of the outstanding BD common stock. |

(1) | Includes (a) shares held directly, (b) with respect to executive officers, indirect interests in BD common stock held under the BD 401(k) Plan, GSIP and the Restoration Plan, and (c) with respect to thenon-management directors, indirect interests in BD common stock held under the Directors’ Deferral Plan. Additional information on certain of these plans appears on pages 5-6. Includes shares under outstanding stock appreciation rights and restricted stock units that executive officers may acquire within 60 days, as follows: Mr. Forlenza, 1,221,894 shares; Mr. Conroy, 109,343 shares; Mr. Polen, 35,676 shares; Mr. Reidy, 99,796 shares; and Dr. Strahlman, 45,355 shares. Also includes, with respect to eachnon-management director, shares issuable under restricted stock units as follows: Mr. Anderson, 24,366 shares; Ms. Burzik, 6,318 shares; Mr. Eckert, 1,553 shares; Dr. Fraser, 20,498 shares; Mr. Jones, 13,410 shares; Mr. Larsen, 18,606 shares; Mr. Mecklenburg, 24,284 shares; Mr. Orr, 24,280 shares; Mr. Overlock, 27,361 shares; Dr. Pomeroy, 5,221 shares; Ms. Rimel, 8,245 shares; and Mr. Scott, 25,795 shares. The above table does not reflect the grant of restricted stock units the persons elected as director at the 2018 Annual Meeting will receive, as the amount of these grants cannot be determined at this time. See“Non-management directors’ compensation—Equity award” on page 15. |

(2) | Messrs. Melcher and Ring currently serve as directors of C.R. Bard, Inc. The above table does not reflect any shares that Messrs. Melcher and Ring may acquire in connection with BD’s pending acquisition of C.R. Bard, Inc., as these amounts are indeterminable at this time. See “Proposal 1—Election of Directors.” The table also does not reflect thepro-rated restricted stock unit award they would each receive upon joining the Board, as this amount is also indeterminable. See “Non-management directors’ compensation—Equity Award.” |

Equity compensation plan information

The following table provides certain information as of September 30, 2017 regarding BD’s equity compensation plans.

| | | | | | | | | | | | |

Plan Category | | (a)

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | | (b)

Weighted-average

exercise price of

outstanding

options, warrants

and rights(1) | | | (c)

Number of securities

remaining available for

future issuance under

equity compensation plan

(excluding securities

reflected in column(a)) | |

Equity compensation plans approved by security holders | | | 10,013,862 | (2) | | $ | 116.30 | | | | 8,231,761 | (3) |

Equity compensation plans not approved by security holders | | | 1,639,001 | (4) | | | N/A | | | | 0 | (5) |

| | | | | | | | | | | | |

Total | | | 11,652,863 | | | $ | 116.30 | | | | 8,231,761 | |

(1) | Shares issuable pursuant to outstanding performance-based restricted stock units and time-vested restricted stock units under the 2004 Plan and BD’s Stock Award Plan, as well as shares issuable under the Directors’ Deferral Plan, the Restoration Plan and the GSIP, are not included in the calculation of weighted-average exercise price, as there is no exercise price for these shares. |

(2) | Shares issuable includes (i) 303,003 stock options and 6,466,001 SARs granted under the 2004 Plan, (ii) 1,079,876 performance-based restricted stock units (assuming maximum payout) and 2,136,218 time-vested units granted under the 2004 Plan, and (iii) 28,764 shares issuable under restricted stock unit awards granted under the Stock Award Plan. The weighted average remaining term of the outstanding options and SARs is 6.08 years. |

(3) | Represents shares available for issuance under the 2004 Plan and includes 3,052,553 shares available for full-value awards, assuming maximum payout of outstanding Performance Units. |

(4) | Includes 129,544 shares issuable under the Directors’ Deferral Plan, 337,670 shares issuable under the Restoration Plan, and 1,171,787 shares issuable under the GSIP. |

(5) | Not shown are shares issuable under the Directors’ Deferral Plan, the Restoration Plan or the GSIP. There are no limits on the number of shares issuable under these plans, and the number of shares that may become issuable will depend on future elections made by plan participants. |

Directors’ Deferral Plan. The Directors’ Deferral Plan allowsnon-management directors to defer receipt, in an unfunded cash account or a BD common stock account, of all or part of their annual retainer and other cash fees. Directors may also defer receipt of the shares underlying their restricted stock unit awards. The number of shares credited to the BD common stock accounts of participants is adjusted periodically to reflect the payment and reinvestment of dividends on the BD common stock. Participants may also elect to have amounts held in a cash account converted into a BD common stock account. Amounts credited to the BD stock fund are paid out in BD shares at the time of distribution. The Directors’ Deferral Plan is not qualified, and participants have an unsecured contractual commitment of BD to pay the amounts due under the Directors’ Deferral Plan.

Restoration Plan. Information regarding the deferral features of the Restoration Plan can be found beginning on page 52 of this proxy statement. The number of shares credited to the BD common stock accounts of participants is adjusted periodically to reflect the payment and reinvestment of dividends on the BD common stock. Amounts credited to the BD common stock accounts of the Restoration Plan are paid out in BD shares at the time of distribution. The Restoration Plan is not qualified, and participants have an unsecured contractual commitment of BD to pay the amounts due under the plan.

GSIP. BD maintains the GSIP for itsnon-U.S. associates in certain jurisdictions outside of the United States. The purpose of the GSIP is to providenon-U.S. associates with a means of saving on a regular and long-term basis and acquiring a beneficial interest in BD common stock. Participants may contribute a portion of their base pay, through payroll deductions, to the GSIP for their account. BD provides matching funds of up to 3% of a participant’s base pay through contributions to the participant’s plan account. A participant may withdraw the vested portion of the participant’s account, although such withdrawals must be in the form of a cash payment if the participant is employed by BD at the time of withdrawal. Following termination of service, withdrawals will be paid in either cash or shares, at the election of the participant.

Section 16(a) beneficial ownership reporting compliance

Section 16(a) of the Securities Exchange Act of 1934 requires BD’s directors and executive officers to file initial reports of their ownership of BD’s equity securities and reports of changes in such ownership with the SEC and the New York Stock Exchange (“NYSE”(the "Board"). Directors and executive officers are required by SEC regulations to furnish BD with copies of all Section 16(a) forms they file with respect to BD securities. Based solely on a review of copies of such forms and written representations from BD’s directors and executive officers, BD believes that, for the period from October 1, 2016 through September 30, 2017, all of its directors and executive officers were in compliance with the reporting requirements of Section 16(a).

Proposal 1. | ELECTION OF DIRECTORS |

Members of our Board are elected to serve a term of one year and until their successors have been elected and qualified. All of the nominees for director have consented to being named in this proxy statement and to serve if elected.

Each

The Board currently has 12 members and 11 of our current directors are standing for election at the 2024 Annual Meeting. Marshall O. Larsen, who has reached the mandatory director retirement age under BD's Governance Principles, is not standing for re-election at the 2024 Annual Meeting. The size of the Board will be reduced to 11 members, effective upon the conclusion of the 2024 Annual Meeting.

Other than Dr. Joanne Waldstreicher, who was elected to the Board in July 2023, all of the nominees

is a current member of BD’s Board, except for Messrs. Melcher and Ring, who currently serve as directors of C.R. Bard, Inc. (“Bard”). Underwere previously elected at the

terms of the agreement by which BD has agreed to acquire Bard, BD is required to appoint Mr. Ring and one other Bard director mutually agreed upon by BD and Bard to the Board upon the closing of the acquisition. In accordance with the terms of the agreement, the Board has appointed Messrs. Melcher and Ring to the Board, subject to and effective upon the closing of the Bard acquisition. Accordingly, the votes on the nominations of Messrs. Melcher and Ring for aone-year term until the 20192023 Annual Meeting of Shareholders (the

“2019"2023 Annual

Meeting”Meeting")

are conditioned upon the Bard acquisition being completed prior to the 2018 Annual Meeting. If the closing of the Bard acquisition has not occurred by the 2018 Annual Meeting, Messrs. Melcher and Ring will not be elected to the Board at the 2018 Annual Meeting, and the votes regarding their nominations will have no effect. They will, however, thereafter become members of the Board upon the closing of the Bard acquisition, to serve until the 2019 Annual Meeting.Except as discussed above regarding Messrs. Melcher and Ring, .

BD does not know of any reason why any nominee would be unable to serve as director. If any nominee is unable to serve, the shares represented by valid proxies will be voted for the election of such other person as the Board may nominate, or the size of the Board may be reduced.

Messrs. Basil L. Anderson and James F. Orr, who have reached the mandatory retirement age under BD’s Corporate Governance Principles (the “Principles”), will retire as members of the Board effective at the conclusion of the 2018 Annual Meeting.

BD directors have a variety of backgrounds, which reflects the Board’s continuing efforts to achieve a diversitymix of viewpoint, experience, knowledge, ethnicitydiverse viewpoints, insights and gender.perspectives on the Board. As more fully discussed below, director nominees are considered on the basis of a range of criteria, including their business knowledge and background, prominence and reputation in their fields, global business perspective and commitment to strong corporate governance and citizenship. They must also have experience and abilitycapability that is relevant to the Board’s oversight role with respect toof BD’s business and affairs. Each nominee’s biography includes the particular experience and qualifications that led the Board to conclude that the nominee should serve on the Board.

NOMINEES FOR DIRECTOR

| | | | | |

|

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR. |

|

|

Proposal 1: Election of directors

Nominees for director—skills and experience

The table below summarizes the key qualifications, skills, and attributes of the nominees for director that served as the basis for the Board's decision to nominate these individuals for election.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Skills & Experience |

Public Company CEO Prior experience as the chief executive officer of a publicly-traded company. | | | | | | | | | | | |

Financial Acumen and Expertise Experience in financial accounting/reporting and corporate finance. | | | | | | | | | | | |

Healthcare Industry Knowledge of or experience in an industry involving healthcare and medical products and services. | | | | | | | | | | | |

Research, Development & Innovation Experience with the innovation, design and development of new products and services, or expertise in a scientific or technological field. | | | | | | | | | | | |

Healthcare Insurance & Reimbursement Experience with the administration of medical care reimbursement programs. | | | | | | | | | | | |

Integrated Health Delivery System Prior executive or senior management position with an organization that owns and operates a network of one or more healthcare facilities. | | | | | | | | | | | |

Healthcare Regulatory or Public Policy Experience with healthcare regulatory schemes and public policies that promote public well-being. | | | | | | | | | | | |

Corporate Governance Knowledge of or experience with the rules, practices, and processes used to direct and manage a company. | | | | | | | | | | | |

International Business Leadership position at an organization that operates internationally. | | | | | | | | | | | |

Shareholder Relations/Institutional Investor Experience Leadership position involving interacting with public company investors or investing on behalf of other parties. | | | | | | | | | | | |

Product Quality & Safety Experience in product quality control and safety systems. | | | | | | | | | | | |

Global Operations & Supply Chain Experience with the global relationships and activities required to manufacture goods and maximize overall supply chain efficiency, including the sourcing of raw materials and vendor management. | | | | | | | | | | | |

Corporate Sales and Marketing Experience with go-to-market strategies and marketing of an organization’s products and services. | | | | | | | | | | | |

| Attributes |

| Independent | | | | | | | | | | | |

| Female | | | | | | | | | | | |

| | | | | |

| 2024 Notice of Annual Meeting and Proxy Statement | 13 |

Proposal 1: Election of directors

Nominees for director

William M. Brown | 61

Former Chairman and Chief Executive Officer, L3Harris Technologies

| | | | | |

| |

Director Since:2022 Independent:Yes Committees: •Compensation and Human Capital •Corporate Governance and Nominating | Skills and experience As a veteran chief executive officer, Mr. Brown brings substantial strategic, financial, operational and innovation expertise to the BD Board, along with a strong corporate governance background and experience in domestic and international business. Professional background •Served as Executive Chair of L3Harris Technologies from June 2021 to June 2022, having served as Chairman and Chief Executive Officer from July 2019 to June 2021. •Previously served as Chairman, President and Chief Executive Officer of Harris Corporation prior to the merger of Harris Corporation with L3 Technologies in 2019. Mr. Brown joined Harris Corporation in November 2011 as President and Chief Executive Officer and was appointed Chairman in April 2014. •Prior to joining Harris Corporation, served in various leadership roles at United Technologies Corporation (UTC), including Senior Vice President of Corporate Strategy and Development and President of UTC Fire & Safety. Public directorships •Celanese Corporation (Lead Director) Former public directorships (last 5 years) •L3Harris Technologies, Inc. •Harris Corporation (until merger with L3 Technologies in 2019) |

| |

Catherine M. Burzik | 73

Former President and Chief Executive Officer, Kinetic Concepts, Inc.

| | | | | |

| |

Director Since:2013 Independent:Yes Committees: •Quality and Regulatory (Chair) •Corporate Governance and Nominating | Skills and experience Ms. Burzik,67, has been is a director since 2013. From 2006 untilseasoned executive in the salehealthcare industry, having led major medical device, diagnostic, diagnostic imaging and life sciences businesses. She contributes to the Board strong strategic, product development and leadership expertise, and extensive knowledge of the companyglobal healthcare field. Professional background •Appointed as Interim CEO of Orthofix Medical Inc. in 2012, she servedSeptember 2023. •Served as President and Chief Executive Officer of Kinetic Concepts, Inc., a medical device company specializing in the fields of wound care and regenerative medicine. Prior thereto, she wasmedicine, from 2006 until the sale of the company in 2012. •Previously served as President of Applied Biosystems and President of Ortho-Clinical Diagnostics, Inc., a Johnson & Johnson company. Ms. Burzik Public directorships •Orthofix Medical Inc. (Chair of the Board and Interim CEO) Former public directorships (last 5 years) •Haemonetics Corporation |

| |

Proposal 1: Election of directors

Carrie L. Byington, M.D. | 60

Special Adviser to the President, University of California Health

| | | | | |

| |

Director Since:2021 Independent:Yes Committees: •Audit •Quality and Regulatory | Skills and experience Dr. Byington provides the Board extensive knowledge and perspective regarding the integrated delivery of healthcare services as a result of her leadership positions at some of the nation’s largest health systems. Dr. Byington also is a directorpossesses strong executive management skills and strategic planning experience, as well as expertise in clinical practice and infectious diseases. Professional background •Has served as Special Adviser to the President of Haemonetics Corporation.Ms. Burzik is a seasoned executiveUniversity of California Health, the largest public academic healthcare system in the healthcare industry, having led major medical device, diagnostic, diagnostic imaging and life sciences businesses. She contributes strong strategic, product development and leadership expertise, and extensive knowledgeUnited States, since 2023.

•Executive Vice President of University of California Health from 2019 to 2023. •Served as Dean of the global healthcare field.College of Medicine, Senior Vice President for Health Sciences for Texas A&M University, and Vice Chancellor for Health Services for Texas A&M System from 2017 to 2019. •From 1995 to 2016, served on the faculty of the University of Utah, serving in multiple leadership roles, including as Director and Principal Investigator, Center for Clinical and Translational Science at University of Utah Health from 2015 to 2016. |

| |

R. Andrew Eckert | 62

Former Chief Executive Officer, Zelis Inc.

| R. Andrew Eckert, 56, has been a director since 2016. Since April 2017, he has served as director

| | | | |

| |

Director Since:2016 Independent:Yes Committees: •Compensation and PresidentHuman Capital (Chair) •Audit | Skills and Chief Executive Officer of Acelity L.P. Inc., a global wound care company. From 2015 until the sale of the company in 2016, he served as the Chief Executive Officer of Valence Health, Inc., a health care information technology and services company. Prior thereto, Mr. Eckert served as Chief Executive Officer of TriZetto Corporation, a healthcare IT solutions firm, and Chief Executive Officer of CRC Health Group, a provider of specialized behavioral healthcare services. Mr. Eckert also is the Chairman of Varian Medical Systems.experience Mr. Eckert is a leader in the growing field of health carehealthcare information technology, with extensive experience as an executive officer of several healthcare companies. He hasalso brings to the Board a deep knowledge of operations, strategic planning, product development and marketing, and has valuable corporate governance insight gained from having served as chief executive officer of publicly-held companies and as a director of severalother public companies. |

| | Vincent A. Forlenza, 64, has been

Professional background •Currently serves as a director since 2011. He became BD’s Chairman in 2012 and was elected itsSenior Advisor to Permira, a global private equity firm. •Served as Chief Executive Officer of Zelis Inc., a provider of healthcare cost management and payments solutions, from 2020 to 2021. •Served as President and Chief Executive Officer of Acelity L.P. Inc., a global wound care company, from 2017 until the sale of the company in 2011. He also2019. •Served as the Chief Executive Officer of Valence Health, Inc., a healthcare information technology and services company, from 2015 until its sale in 2016. •Previously served as BD’s President from 2009 to April 2017, and asChief Executive Officer of TriZetto Corporation, a payer technology solutions firm, until its Chief Operating Officer from July 2010 to October 2011. Mr. Forlenza also is a member of the Board of Directors and former Chairman of the Advancedsale in November 2014. Public directorships •Fortrea Holdings Inc. (Lead Director) Former public directorships (last 5 years) •Varian Medical Technology Association (AdvaMed), an international medical technology trade organization. He is a member of the Board of Trustees of The Valley Health System and a member of the Board of Directors of the Quest Autism Foundation.Mr. Forlenza has been with BD for over 36 years in a number of different capacities, including strategic planning, business development, research and development and general management in each of BD’s segments and in overseas roles. Mr. Forlenza brings to the Board extensive business and industry experience, and provides the Board with a unique perspective on BD’s strategy and operations, particularly in the area of new product development.

Systems, Inc. |

| |

| | | | | |

2024 Notice of Annual Meeting and Proxy Statement | 15 |

Proposal 1: Election of directors

Claire M. Fraser, Ph.D. | 68

Founding Director, Institute for Genome Sciences and Professor of Medicine and Microbiology and Immunology, University of Maryland School of Medicine

| Claire M. Fraser, Ph.D, 62, has been a director since 2006. Since 2007, she has been

| | | | |

| |

Director of the Institute for Genome SciencesSince:2006 Independent:Yes Committees: •Compensation and a Professor of Medicine at the University of Maryland School of Medicine in Baltimore, Maryland. From 1998 to 2007, she served as PresidentHuman Capital •Corporate Governance and Director of The Institute for Genomic Research, anot-for-profit center dedicated to decipheringNominating | Skills and analyzing genomes. Dr. Fraser also serves on the Board of the American Association for the Advancement of Science, the Maryland Technology Development Corporation (TEDCO) and Ohana Biosciences Inc.experience Dr. Fraser is a prominentan internationally recognized scientist withwho contributes to the Board a strong background in genomics, infectious diseases and molecular diagnostics, including the development of novel diagnostics and vaccines. She also brings considerable managerial experience, inhaving established and led two large research institutes for over 30 years, and through her field. |

| | Christopher Jones, 62, has beenexperience as a director of several biotechnology companies and non-profit organizations.

Professional background •Founding Director of the Institute for Genome Sciences and Professor of Medicine and Microbiology and Immunology at the University of Maryland School of Medicine since 2010. Mr. Jones retired2007. •Served as President and Director of The Institute for Genomic Research, a not-for-profit research organization engaged in 2001human and microbial genomics studies, from 1998 to 2007. •Previously served as Chief Executive OfficerChair of JWT Worldwide (previously known as J. Walter Thompson), an international marketing firm. Hethe Board and a Director of the American Association for the Advancement of Science, and is a member of the National Academy of Sciences and National Academy of Medicine. •Previously served as a Director of Ohana Biosciences Inc. Public directorships •Seres Therapeutics, Inc. |

| |

Jeffrey W. Henderson | 59

Former Chief Financial Officer of Cardinal Health Inc.

| | | | | |

| |

Director Since:2018 Independent:Yes Committees: •Audit (Chair) •Compensation and Human Capital | Skills and experience Mr. Henderson is an experienced healthcare executive who brings to the Board of Trustees of The Pew Charitable Trusts, and a memberdeep knowledge of the Board of Directors of the Albertindustry, along with strong financial, strategic and Mary Lasker Foundation. Heoperational expertise and significant international experience. Mr. Henderson also isbrings valuable corporate governance experience from his service as a director of other public companies. Professional background •Served as Chief Financial Officer of Cardinal Health Inc., a global healthcare products and services company, from 2005 to 2014. •Held multiple positions at Eli Lilly and General Motors, including international positions, prior to joining Cardinal Health. •President of JWH Consulting LLC, a business and investment advisory firm, focused primarily on the Cello Group, Chairman of Palmer Hargreaves, andhealthcare industry. •Served as an Advisory Director to Berkshire Partners LLC, a memberprivate equity firm, from September 2015 to December 2019. Public directorships •Qualcomm, Inc. •FibroGen, Inc. •Halozyme Therapeutics, Inc. (Chair of the Health Advisory Board of The Johns Hopkins University Bloomberg School of Public Health.Board) |

| |

Proposal 1: Election of directors

Christopher Jones | 68

Former Chief Executive Officer, JWT Worldwide

| | | | | |

| |

Director Since:2010 Independent:Yes Committees: •Audit •Corporate Governance and Nominating (Chair) | Skills and experience Mr. Jones contributesbrings to the Board an important international perspective based on his distinguished career as a marketing leader and head of a global marketing firm. He offers substantial marketing, strategic and managerial expertise derived from his broad range of activities in the field. |

| | Marshall O. Larsen, 69, has been a director since 2007. Mr. Larsen retired in 2012

Professional background •Served as Chairman, President and Chief Executive Officer of Goodrich Corporation, a supplier of systems and servicesJWT Worldwide (previously known as J. Walter Thompson), an international marketing firm, from 1996 to the aerospace and defense industry. Mr. Larsen also is a director of Air Lease Corporation, Lowe’s Companies, Inc. and United Technologies Corporation.As a veteran chief executive officer of a public company, Mr. Larsen offers the valuable perspective of an individual with highly-developed executive leadership and financial and strategic management skills in a global manufacturing company. These qualities reflect considerable domestic and international business and financial experience.

|

| | Gary A. Mecklenburg, 71, has been a director since 2004. In 2006, he retired as President and Chief Executive Officer of Northwestern Memorial HealthCare, a position he had held since 1986, and he also served as President of Northwestern Memorial Hospital from 1985 to 2002. He is currently a director of LHP Hospital Group, Inc. and Froedtert Health, Inc.

Mr. Mecklenburg’s long tenure in hospital administration affords him a broad perspective on the many facets2001.

•Chair of the deliveryBoard of healthcareTrustees of The Pew Charitable Trusts and a deep knowledge of healthcare financing and administration. As the former leader of a major teaching hospital, Mr. Mecklenburg possesses strong executive management, financial, strategic and operational knowledge as applied in a healthcare setting. |

| | |

| | David F. Melcher, 63, will become a director upon the closing of BD’s acquisition of Bard. He has served as a director of Bard since 2014, and has served on its Finance, Audit and Compensation and Personnel committees of Bard’s board. Since 2015, he has served as President and Chief Executive Officer of Aerospace Industries Association, a trade association representing major aerospace and defense manufacturers and suppliers, a position he plans to leave at the end of 2017. From 2011 to 2015, he was Chief Executive Officer, President and a member of the Board of Directors of Exelis Inc.,The Albert and Mary Lasker Foundation.

•Member of the Health Advisory Board of The Johns Hopkins University Bloomberg School of Public Health. •Chair of the Board of Newrotex Ltd. |

| |

Thomas E. Polen | 50

Chairman, Chief Executive Officer and President, BD

| | | | | |

| |

Director Since:2020 Independent:No Committees: None | Skills and experience Mr. Polen has spent over 20 years with BD in a diversified,number of capacities of increasing responsibility, including oversight responsibility for all three of BD's business segments, global aerospace defense, informationresearch and technology services company, having served as Presidentdevelopment, innovation, operations and the commercial organization of ITT Defense and Information Solutions until Exelis Inc. spun off from ITT in 2011. PriorBD's Americas region. Mr. Polen brings to 2008, Lieutenant General (Ret.) Melcher spent 32 years of distinguished service in the U.S. Army.Mr. Melcher brings strong executive experience as a result of his many years in leadership positions in the defense community and as a former chief executive officer of a public company. Mr. Melcher offers the perspective of a seasoned executive withBoard extensive industry experience and business expertise, particularly in the areas of domesticstrategy and international business, program management, strategy development, financeinnovation, and IT.

|

| | Willard J. Overlock, Jr., 71, has been a director since 1999. He retired in 1996 as a partner in Goldman, Sachs & Co., where hein-depth knowledge of BD’s businesses and served as a member of its Management Committee, and retains the title of Senior Director to The Goldman Sachs Group, Inc. Mr. Overlock is a member of the Board of Directors of Evercore Partners, Inc., a trustee of Rockefeller University, and Chairman of the Board of Directors of the Albert and Mary Lasker Foundation. Mr. Overlock also is a member of the Board of the Cue Ball Group, LLC.

Mr. Overlock has broad financial and investment banking experience based on his senior leadership roles in these areas. He contributes financial and transactional expertise and acumen in mergers and acquisitions and complex financial transactions.

|

| | Claire Pomeroy, 62, has been a director since 2014. Since 2013, she has served as the President of the Albert and Mary Lasker Foundation, a private foundation that seeks to improve health by accelerating support for medical research through recognition of research excellence, public education and advocacy. Prior thereto, Dr. Pomeroy served as Dean of the University of California, Davis (“UC Davis”) School of Medicine, andmarkets.

Professional background •BD's Chief Executive Officer since 2020, and appointed Chairman in 2021. •Has served as BD’s President since April 2017, and also served as BD's Chief Operating Officer from October 2018 to January 2020. •Served as Executive Vice President and President of the UC Davis Health System. Dr. Pomeroy also is a member of the Board of Directors of the Sierra Health Foundation, New York Academy of Medicine, New York Blood Center, and the Foundation for Biomedical Research. She is a member of the Board of Trustees of the Morehouse School of Medicine.Dr. Pomeroy is an expert in infectious diseases, with broad experience in the area of healthcare delivery, health system administration, higher education, medical research and public health. She bringsBD’s Medical segment prior to the Board important perspectives in the areas of patient care services, global health and health policy.

becoming President. Public directorships •Walgreens Boots Alliance |

| | Rebecca W. Rimel, 66, has been a director since 2012. Since 1994, she has served as President and Chief Executive Officer of The Pew Charitable Trusts, a public charity that works to improve public policy and inform the public. Ms. Rimel previously served as Assistant Professor in the Department of Neurosurgery at the University of Virginia Hospital and also as Head Nurse of its medical center emergency department. Ms. Rimel also is a director of BioTelemetry, Inc. and a director/trustee of various Deutsche mutual funds.

Ms. Rimel brings executive leadership and extensive experience in public policy and advocacy, particularly in the area of healthcare. She also offers the perspective of someone with a strong background in the healthcare field.

|

| | | | | |

2024 Notice of Annual Meeting and Proxy Statement | 17 |

Proposal 1: Election of directors

Timothy M. Ring | 66

Former Chairman and Chief Executive Officer, C. R. Bard, Inc.

| Timothy M.

| | | | |

| |

Director Since:2017 Independent:Yes Committees: •Audit •Quality and Regulatory | Skills and experience Mr. Ring, 60, is contributes to the Board deep expertise resulting from his 20 years of experience in various leadership positions at C. R. Bard, including as Chairman and Chief Executive Officer. Mr. Ring's expertise covers many facets of business, including strategy, product development, financial matters and international operations, and he has extensive experience in the healthcare industry. Professional background •Served as C. R. Bard’s Chairman and Chief Executive Officer of Bard. Mr. Ring will become a director of BD upon the closing of BD’s acquisition of Bard. Mr. Ring also is a director of Quest Diagnostics Incorporated, and aco-founderfrom 2003 until 2017, when it was acquired by BD. •Co-founder of TEAMFund, Inc., an impact fund focused on delivering medical technology tosub-Saharan Africa and India.With over 20 years

Public directorships •Quest Diagnostics Incorporated (Lead Director) |

| |

Bertram L. Scott | 72

Former Chief Executive Officer, Affinity Health Plan

| | | | | |

| |

Director Since:2002 Independent:Yes Committees: •Compensation and Human Capital •Quality and Regulatory | Skills and experience Mr. Scott adds strong strategic, operational and financial experience to the Board from the variety of executive roles in which he has served during his career. He also brings experience in various leadership positions at Bard, including as Chairmancorporate governance and Chief Executive Officer, Mr. Ring offers a unique perspective on the Bard business. As an experienced chief executive officer of a public company, Mr. Ring contributesbusiness expertise in many facets of business, including strategy, product developmentthe insurance and international operations, and has extensive experience in the healthcare industry. |

| | Bertram L. Scott, 66, has been a director since 2002. Mr. Scott isfields.

Professional background •Served as Senior Vice President of Population Health of Novant Health an integrated network of physician practices, outpatient centers and hospitals. He previouslyfrom 2015 to 2019. •Previously served as President and Chief Executive Officer of Affinity Health Plan, and as President, U.S. Commercial of CIGNA Corporation. Prior thereto, Mr. Scott •Also previously served as Executive Vice President of TIAA-CREF and as President and Chief Executive Officer of TIAA-CREF Life Insurance Company. Mr. Scott also is a director of AXA Financial, Public directorships •Dollar Tree, Inc., •Equitable Holdings, Inc. •Lowe’s Companies, Inc. Former public directorships (last 5 years) •AllianceBernstein L.P./AllianceBernstein Holding L.P. |

| |

Proposal 1: Election of directors

Joanne Waldstreicher, M.D. | 63

Former Chief Medical Officer, Johnson & Johnson

| | | | | |

| |

Director Since:2023 Independent:Yes Committees: •Corporate Governance and Tufts Health Plan.Mr. Scott possesses strong strategic, operationalNominating

•Quality and financialRegulatory | Skills and experience from Dr. Waldstreicher brings to the varietyBoard over 30 years of executive roles in which he has served during his career. He brings experience in corporate governanceclinical and business expertise instrategic leadership roles, with an emphasis on clinical development, product development strategy, safety and regulatory affairs. Professional background •Served as chief medical officer of Johnson & Johnson (J&J) from 2012 to 2023. •Previously served as chief medical officer of Janssen Pharmaceutical Research and Development, a division of J&J from 2009 to 2012. Prior to that, Dr. Waldstreicher served as vice president and as senior vice president of Global Drug Development at Janssen from 2002 to 2009. •Prior to J&J, she led endocrinology and metabolism clinical research at Merck Research Laboratories. •Serves on an expert panel for the insuranceReagan Foundation for the U.S. Food and healthcare fields.Drug Administration •Serves as faculty affiliate of the Division of Medical Ethics, Department of Population Health at New York University School of Medicine. Public directorships •Structure Therapeutics, Inc. |

| |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE NOMINEES FOR DIRECTOR.

Board refreshment, nomination and diverse representation

Our Board members have strong track records of success in business, finance, healthcare, and value creation, along with deep management experience that helps guide BD’s strategy. The Board believes sustaining the right mix of diverse skills and Committeesexperiences on the Board is crucial to BD’s continued success. Therefore, the Board regularly performs self-assessments and conducts a robust director renomination process to ensure it continues to be a source of competitive advantage for BD.

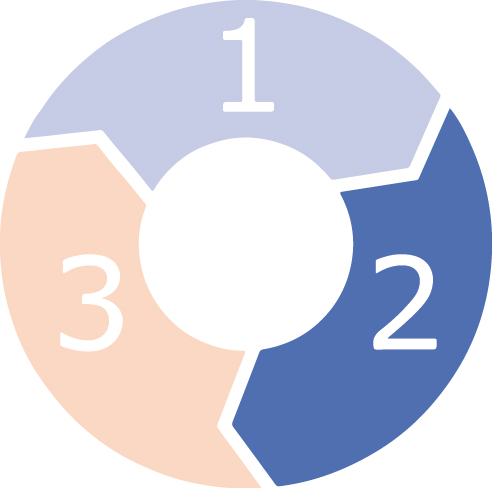

BD’s board evaluation and nomination process includes three essential stages:

| | | | | | | | | | | | | | | | | | | | |

| Evaluation of

Board

Composition | è | Assessment of

Individual

Directors | è | Nomination

of Directors | |

The Board’s self-evaluation process is used to identify and assess potential gaps in diversity of thought through key skills and experience required to support BD’s current strategic interests. In addition, the Governance Committee undertakes a robust review prior to recommending the renomination of any sitting director, including their effectiveness during the past year, their outside time commitments, their tenure on the Board, and the needs of the Board

BD going forward in the context of BD’s strategy. Our Governance Principles state that Board members should not expect that, once elected, they will necessarily be renominated to the Board.

The Board seeks to have a mix of long-, mid- and short-tenured directors to ensure a balance of views and insights. When reviewing its composition, the Board balances the benefits it receives from the knowledge and understanding of our complex businesses that directors gain from longer-term service with the need to bring fresh ideas and perspectives to the Board through the addition of new directors.

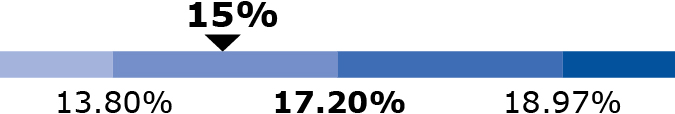

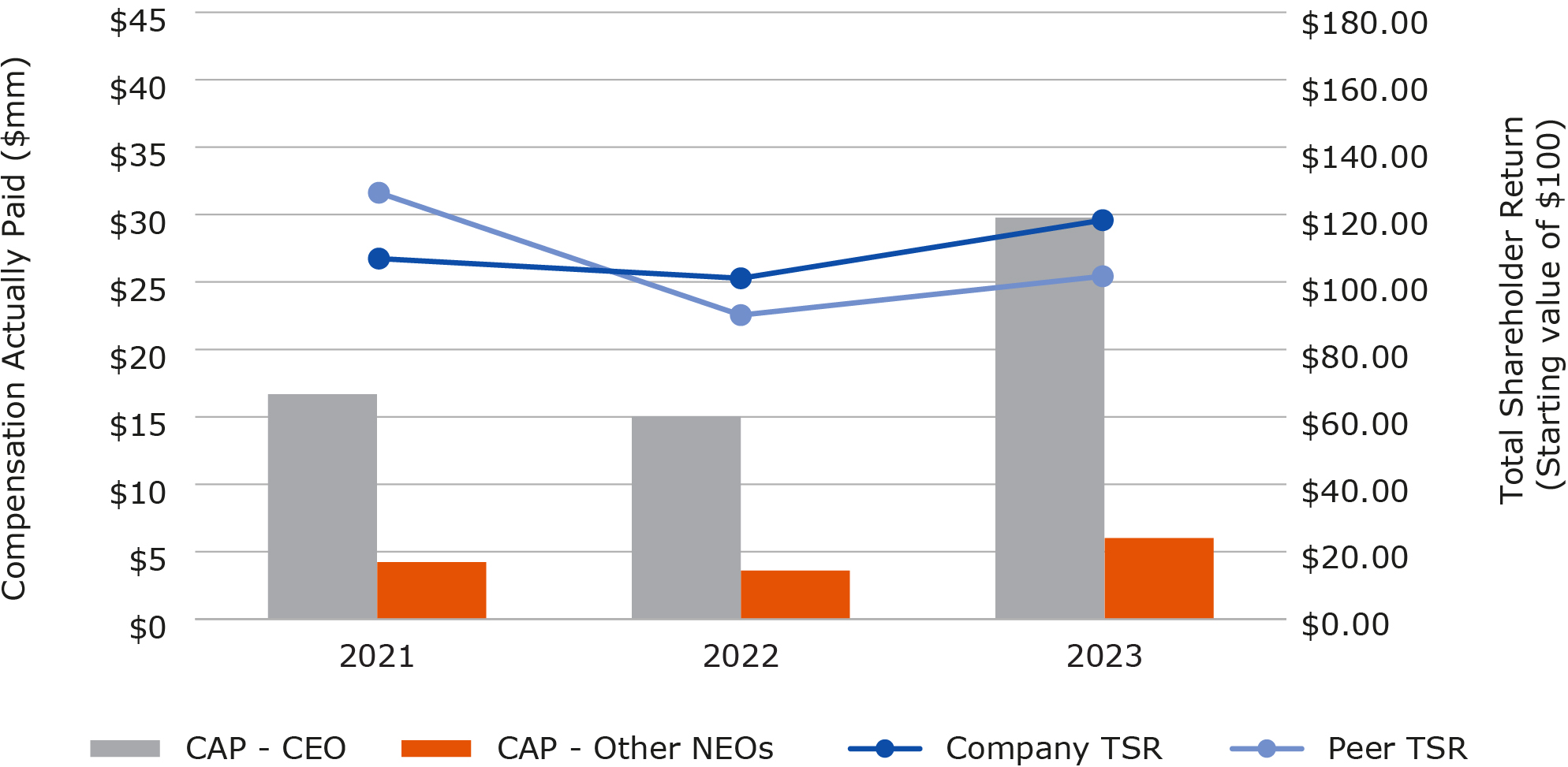

| | | | | |